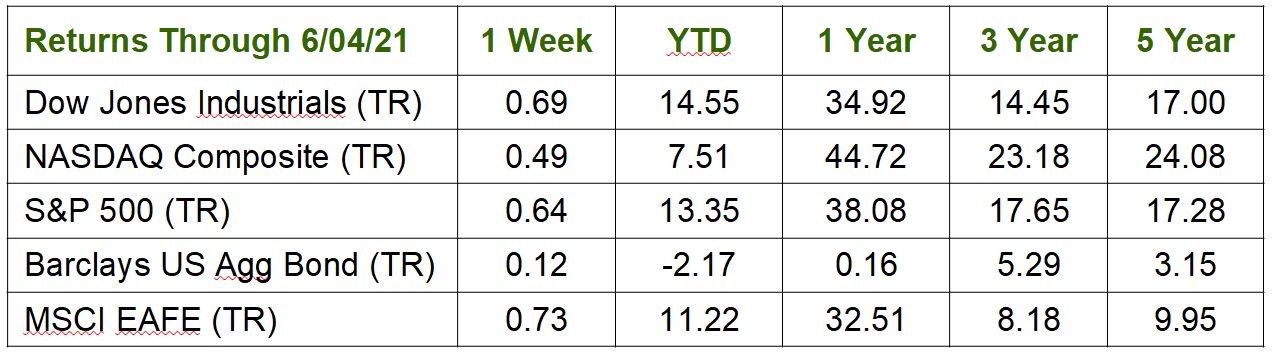

Stocks rose Friday. The Labor Department’s May jobs report showed unemployment fell to a pandemic-era low of 5.9 percent, and new job growth was stronger than April’s but short of expectations. The mixed news appeared to assure investors the Fed would retain its accommodating money policies. For the week, the Dow rose 0.69 percent to close at 34,756.39. The S&P gained 0.64 percent to finish at 4,229.89, and the NASDAQ climbed 0.49 percent to end at 13,814.49.

Did You Need It? — 40.3 percent of college graduates aged 22 to 27 are working in jobs in which they are underemployed, i.e., they are working in a job that typically does not require a college degree. Historically, 33.5 percent of college grads are underemployed (source: Federal Reserve Bank of New York, BTN Research).

Will It Be Spent Eventually? — The personal savings rate in the U.S. in the first quarter 2021 was 21 percent. The personal savings rate in the U.S. in the first quarter 2001 was 5 percent. The personal savings rate is defined as savings (i.e., after-tax income less consumption spending) divided by after-tax income (source: Department of Commerce, BTN Research).

Not a Big Number? — At its peak, 3.7 million home mortgages (out of 52.4 million mortgages nationwide) had requested and received forbearance protection afforded through the CARES Act that was signed into law by President Donald Trump on March 27, 2020. As of March 2021, that total had fallen to 2.2 million home mortgages still in forbearance, or just 4.2 percent of all mortgages (source: Federal Reserve Bank of New York, BTN Research).

WEEKLY FOCUS – June Is Alzheimer’s & Brain Awareness Month

It’s difficult to find someone who has not been emotionally and/or financially impacted by Alzheimer’s. Alzheimer’s is one of our nation’s costliest diseases. According to the Alzheimer’s Association, total payments for all individuals with Alzheimer’s or other dementias are estimated to total $355 billion in 2021 (not including unpaid caregiving). Sadly, afflicted individuals without adequate long-term care insurance frequently lose most, if not all, of their financial assets.

But even dementias’ beginning stages and mild cognitive impairment experienced by healthy seniors can put personal wealth at risk. That’s why it’s important to begin having conversations about your aging family member’s finances well before you see signs of mental decline. Obviously, this has to be done with great sensitivity and respect. Make sure they know you don’t want to take control, but you would like to ensure they are protected and their wishes honored in the years to come.

During ongoing dialogs, try to learn what you’ll need to know if it becomes necessary to manage their finances: the names and contact information of their financial planner, accountant, and attorney; financial records and where they are kept; their monthly income and the sources; insurance policies; the location of financial accounts; regular bills and how they are paid; and log-in information for online accounts.

Suggest meeting jointly with their financial professional and/or other family members. Gain an understanding of their priorities and wishes. Ask which assets are most important to them, what causes they want to support, and whether their will is up to date.

Propose having legal documents created that will allow you or another family member to make decisions if your loved one becomes unable to. This can include: a health care power of attorney (POA) or a more limited living will, either a limited or durable power of attorney for finances, an authorization to disclose account information, and a form authorizing a financial institution to contact you if concerns arise about their ability to manage finances. Not having these documents when they’re needed can make helping your elderly relative considerably more difficult. For example, without a POA, you may need to go to court to attain guardianship of your family member to access accounts on their behalf.

Contact our office if you would like more information about protecting your loved one or help to create a plan to care for them.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Morgan Stanley Capital International Europe, Australia and Far East Index (MSCI EAFE Index) is a widely recognized benchmark of non-U.S. stock markets. It is an unmanaged index composed of a sample of companies representative of the market structure of 20 European and Pacific Basin countries and includes reinvestment of all dividends. Barclays Capital Aggregate Bond Index is an unmanaged index comprised of U.S. investment-grade, fixed-rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and 10 years. Written by Securities America, Copyright June 2021. All rights reserved. Securities offered through Securities America, Inc., broker-dealer and member of FINRA and SIPC. Investment advisory services offered through Securities America Advisors, Inc. and/or Arbor Point Advisors LLC, registered investment advisers. Securities America, Inc., Securities America Advisors, Inc., and Arbor Point Advisors LLC are separately owned and other entities and/or marketing names, products or services referenced here are independent. Securities America • 12325 Port Grace Blvd. • La Vista, NE 68128 • 800-747-6111 • securitiesamerica.com # 3621494.1